Investing in IPOs

Bid for latest IPOs and create wealth for future.

Experience a new-age approach to IPO investing with our platform, unlocking a plethora of exclusive benefits that set us apart from the competition

IPO - Initial Public Offerings

Open

| Companies | Closes On | Price Range |

|---|---|---|

| Grand Continent Hotels Ltd | 24 Mar 2025 | ₹ 107 - ₹ 113 |

Upcoming IPO

| Name | Bidding Date | Price Range |

|---|---|---|

| No Data Found |

Listed

| Name | Listed on | Issue Price | Status |

|---|---|---|---|

| Balaji Phosphates Ltd | 7 Mar 2025 | ₹ 70 | Listed at ₹ 75 for 7.14% gains |

| HP Telecom India Ltd | 28 Feb 2025 | ₹ 108 | Listed at ₹ 115.05 for 6.53% gains |

| Royal Arc Electrodes Ltd | 24 Feb 2025 | ₹ 120 | Listed at ₹ 120 for 0.00% loss |

| Tejas Cargo India Ltd | 24 Feb 2025 | ₹ 168 | Listed at ₹ 175 for 4.17% gains |

| Quality Power Electrical Equipments Ltd | 24 Feb 2025 | ₹ 425 | Listed at ₹ 432.05 for 1.66% gains |

| Hexaware Technologies Ltd | 19 Feb 2025 | ₹ 708 | Listed at ₹ 731 for 3.25% gains |

| Maxvolt Energy Industries Ltd | 19 Feb 2025 | ₹ 180 | Listed at ₹ 180 for 0.00% loss |

| Voler Car Ltd | 19 Feb 2025 | ₹ 90 | Listed at ₹ 90 for 0.00% loss |

| P S Raj Steels Ltd | 19 Feb 2025 | ₹ 140 | Listed at ₹ 145 for 3.57% gains |

| Ajax Engineering Ltd | 17 Feb 2025 | ₹ 629 | Listed at ₹ 593 for -5.72% loss |

IPO - Initial Public Offerings

Open

| Companies | Closes On | Price Range |

|---|---|---|

| Currently There is No Ipo |

Upcoming IPO

| Name | Bidding Date | Price Range |

|---|---|---|

| No Data Found |

Listed

| Name | Listed on | Issue Price | Status |

|---|---|---|---|

| Balaji Phosphates Ltd | 7 Mar 2025 | ₹ 70 | Listed at ₹ 75 for 7.14% gains |

| HP Telecom India Ltd | 28 Feb 2025 | ₹ 108 | Listed at ₹ 115.05 for 6.53% gains |

| Royal Arc Electrodes Ltd | 24 Feb 2025 | ₹ 120 | Listed at ₹ 120 for 0.00% loss |

| Tejas Cargo India Ltd | 24 Feb 2025 | ₹ 168 | Listed at ₹ 175 for 4.17% gains |

| Quality Power Electrical Equipments Ltd | 24 Feb 2025 | ₹ 425 | Listed at ₹ 432.05 for 1.66% gains |

| Hexaware Technologies Ltd | 19 Feb 2025 | ₹ 708 | Listed at ₹ 731 for 3.25% gains |

| Maxvolt Energy Industries Ltd | 19 Feb 2025 | ₹ 180 | Listed at ₹ 180 for 0.00% loss |

| Voler Car Ltd | 19 Feb 2025 | ₹ 90 | Listed at ₹ 90 for 0.00% loss |

| P S Raj Steels Ltd | 19 Feb 2025 | ₹ 140 | Listed at ₹ 145 for 3.57% gains |

| Ajax Engineering Ltd | 17 Feb 2025 | ₹ 629 | Listed at ₹ 593 for -5.72% loss |

Why Us

Built upon principles of transparency and security, ensuring the safety of your investments.

0% Commission

Choose from our vast investment portfolio at 0% commission and enjoy all the benefits!

Trust

We have gained the faith of 20+lakh happy customers over the last 30 years.

Seamless Investing

Enjoy hassle-free investment processes. Open your account with AEKAY in just a few minutes and start investing!

Research Backed Recommendations

Our advisory is backed by top-grade research & analysis. We are always happy to help you.

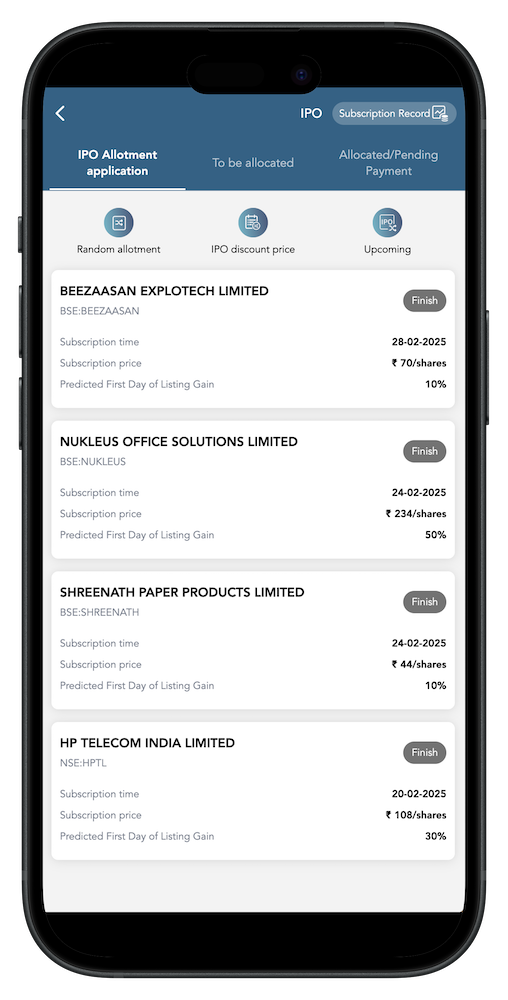

Apply IPO With 3 Easy Steps

Step 1

Open Aekay App and click IPO

Step 2

Select the preferred IPO in the upcoming IPOs list

Step 3

Bid for the IPO

Frequently Asked Questions

What is an IPO?

An IPO investment is an investment in the shares of a company that is going public for the first time. IPOs can be a risky investment, but they can also be very profitable. An IPO’s success depends on several factors, including the company’s financial performance, the overall market conditions, and the demand for the shares.

What does IPO mean?

When a company offers its shares for the first time to the public, it is released for Initial Public Offering (IPO), and the stock gets listed on the stock exchange, i.e., BSE or NSE. This allows the company to raise capital from a wider pool of investors and allows its shareholders to sell their shares on the open market.

What does upcoming IPOs means?

Upcoming IPOs refer to initial public offerings that are scheduled to take place in the near future. These IPOs are typically announced by the companies involved a few weeks or months in advance, allowing investors to buy shares in the company before it goes public.

What does recently listed IPOs means?

Recently Listed IPOs refer to stocks recently listed on a stock exchange. These IPOs are typically still in the early stages of their public life and may be more volatile than more established stocks.

What is issue size?

Issue size is the total number of shares a company offers to the public in an initial public offering (IPO). It is calculated by multiplying the number of shares offered by the issue price per share.

The issue size is a crucial factor in determining the success of an IPO. A large issue size can attract more investors and generate more interest in the company. However, a large issue size can also dilute the ownership of existing shareholders and make it more difficult for the company to control its stock price.

What is Price Band?

A price band is a range of prices within which a company can sell its shares in an initial public offering (IPO). The company and its investment bankers typically set the price band, and it is based on several factors, including the company’s financial performance, the overall market conditions, and the demand for the shares. The price band is important because it gives investors a range of prices to consider when bidding for shares in the IPO.

What is DRHP?

DRHP stands for Draft Red Herring Prospectus. It is a document filed with the Securities and Exchange Board of India (SEBI) by a company planning to raise capital through an initial public offering (IPO). The DRHP provides investors with information about the company, such as its financial performance, management team, and business plan.

What is RHP?

RHP stands for Red Herring Prospectus. It is a preliminary prospectus filed with SEBI by a company planning to raise capital through an initial public offering (IPO). The RHP provides investors with information about the company, such as its financial performance, management team, and business plan. The RHP is an important document for investors to read before deciding whether to invest in an IPO. It provides investors with the information they need to make an informed decision.

Who can invest in IPO?

In India, anyone can invest in an IPO, subject to specific eligibility criteria. These criteria are set by the Securities and Exchange Board of India (SEBI). You must be a resident of India and must have a valid PAN card to invest in an IPO.